Schedule C Filer

Taxpayers often start a home-based business, a side-business, a part-time business, or a full-time business—regardless of which one of these options you fall under, you are regarded by the IRS to be a Schedule C Filer.

Taxpayers often start a home-based business, a side-business, a part-time business, or a full-time business—regardless of which one of these options you fall under, you are regarded by the IRS to be a Schedule C Filer.

The IRS defines a deductible business expense as a cost that must be both ordinary and necessary. Ordinary is one that is common and accepted in your industry. Necessary is a cost that is helpful and appropriate for your business. Further, the IRS says that an expense “does not have to be indispensable to be considered necessary.” This definition is taken from the IRS Publication 535: Business Expenses. Here’s a link to the 57 page publication if you’d like to read more!

Following are some frequently asked questions regarding the Schedule C.

Good question and we will point you right back to the IRS definition given above. But to answer your question specifically, you can also download the PDF or linked above. Those worksheets list common deductions for Schedule C filers. Additionally, the rest of these FAQs will get into specific deductions.

The home office is exactly that—an office for your business in your home. This is a common deduction for Schedule C filers, but the IRS has specific guidelines that must be followed in order to deduct the home office. The business part of your home must be:

If you meet these requirements, you can deduct a percentage of your home expenses (mortgage/rent, insurance, utilities, etc.) as a business deduction. The worksheets linked above have a section to input the necessary information.

The costs of operating a car, truck, or other vehicle in your business may be deductible. When answering this question, we refer to Publication 463: Travel, Gift, and Car Expenses. In order to deduct vehicle expenses, you need to drive for business purposes!

The deduction depends, first, on where your main place of business is. This could be your home-office or an office/location that is your ordinary place of business. (If your ordinary place of business is not your home-office, you cannot deduct commuting miles to/from your home to your place of business.)

Once that is established, you need to track your business mileage (Here is a recommended mileage tracking app).

To deduct the vehicle, we have two methods:

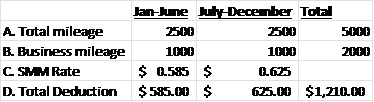

To calculate your SMRM deduction, you need to have your mileage for the year. We also need to split that mileage between personal mileage and business mileage so we do not deduct mileage that should not be. The SMRM Rate is set by the IRS every year—for 2022 the SMRM Rate is 58.5 cents for January through June and 62.5 cents after June.

Let’s say you drove your vehicle a total of 5,000 miles in 2022. And of those 5,000, a total of 2,000 were for your Schedule C—half in Jan-June and half in July-December. Your SMRM calculation looks like this:

For SMRM purpose, the IRS allows us to add these additional expenses:

So if you are going to use the SMRM, it’s a good practice to tally up all of your vehicle expenses.

The idea is similar to the SMRM and it is an absolute must with both methods that you track your mileage!

But instead of using the IRS-given SMRM Rate, you deduct a percentage of all vehicles related expenses for the year. Common AEM expenses include:

If you use your vehicle 40% of the time for business purposes, then you get to deduct 40% of the expenses.

The last thing with the AEM is: depreciation. This can get complicated. Here’s a short video explaining depreciation.

It depends! 9 times out of 10 we recommend using the SMRM though. Especially if the vehicle is used less than 50% of the time for business. It just doesn’t make sense to try depreciation with all the complications.

Yes, you can. On our worksheet we have a section for ‘large purchase over $500.” You can list it there.

Vehicle expenses are just one aspect of ‘travel’ that you can deduct. Travel also includes rental cars, hotels, airfare, Uber/Lyft/taxis. If you travel to a conference, or to visit with a client, you are allowed to deduct the travel expenses associated with that visit.

These types of expenses are reported on a different line item on Schedule C than Vehicle Expenses and should be accounted for separately.

If you do a little sight-seeing or visit a museum or two, but the trip is essentially (majority) business, just deduct the entire cost of travel.

The issue is when you plan a vacation and want to get creative and deduct the entire cost of the vacation. If the trip is a personal trip or a personal vacation, we do not recommend that you deduct the cost of the travel.

There are legitimate times when there is a mixture of both so using a percentage of the deductions as a business expense should be done.

To deduct clothing as uniforms it must include your business name/logo, be protective clothing/gear, or be some other article of clothing designed specifically for your business.

Business attire, ‘street’ clothes, suits, t-shirts, shorts, jeans, etc. are not in and of themselves a tax deduction. They must serve a specific business purpose (i.e. as advertisement, protection, etc.).

You are allowed to deduct meals. Deductible meals need to be for a specific business purpose. These meals include but are not limited to meals with a client, with employees, while on a business trip, or with vendors.

Yes. Entertainment is not allowed as a deduction. Entertainment includes any activity generally considered to provide entertainment, amusement, or recreation.

This includes country club dues, gyms, hobby associations, etc. These are expressly prohibited as a deduction by the IRS.

There are certain expenses that need to be split as part personal and part business. Internet service and cell phone service are a couple of those types of deductions. On the worksheet, there are line items for these two expenses, but also include the percentage you think is business use so we deduct the proper amount.

It depends. Anytime you provide a service to a charity, there is no deduction. The IRS does not allow a deduction for donated time.

If you donate products or goods, then those should be included on the expense line item on the worksheet as if they ran through your business as usual.

If you donate money, you should determine if this donation was an advertisement or a sponsorship or if it was an actual donation. If an advertisement/sponsorship then you can deduct this as advertisement/marketing. If an actual donation, this is not a business deduction, but can be used as a personal deduction.

The IRS is clear about what a tax deduction is. To elaborate on that though, any expense that you had to ‘do’ for business is deductible unless expressly prohibited by the IRS.

We have created the following resources to help you understand what we will need to complete your tax return:

Our primary appointment method is going to be virtual due to continued COVID-19 restrictions. However, each tax professional (Joel, John, and Matt) have opted to individually chart their own course in regards to in-office appointments. John’s circumstances allow for no in-office appointments. Matt and Joel will make themselves available for in-office appointments on a limited basis to clients with special circumstances and needs. We ask our clients to work with us again this year and use the resources we have provided. If you desire an in-office appointment, please contact our office. We can be reached by phone at 909-797-3140 or by email at info@prospecttax.com.

No appointment is necessary. You can drop off documents any time during normal business hours. Or you can upload documents to your online Client Center account any time. If you need to explain your situation or tax documents before we get started, just let the Prospect team know and we will arrange for a phone call before your project gets started.

The Client Center is our online client portal. You can use the Client Center to:

Part of our new process includes a Virtual Appointment (phone or web meeting) with you after the initial preparation of your tax return. Since most of the busy work will be done, we will use all of our time to review your taxes together, ensure nothing has been missed, answer your questions, explain the next steps, and do some planning for the coming year. The goal is for you to leave this meeting feeling great about your tax return and completely in control of the process! Of course, if questions come up before you sign, just let our team know so they can connect you with your Tax Pro.

Yes! If you would like to schedule your Virtual Appointment (phone call or web meeting) in advance, please call our office at 909-797-3140 or use the following links: john – www.caIendIy.com/johnhopkins JoeI – www.caIendIy.com/joelhendriks Matt – www.caIendIy.com/mattkaiser

If you haven‘t scheduled an appointment in advance, we will contact you as soon as your documents are received by our office.

All Individual income tax returns can be signed electronically. The IRS doesn‘t allow electronic signature for Corps, Partnerships, Trusts, or Estates. When your tax return is complete, you will receive an email that walks you through the process. We use a service called SafeSend Returns to assist with these final steps of the tax return process.

Once your tax return is signed and we’ve received your signed documents, we will electronically file your income tax return. There is nothing left for you to do except pay your invoice to us and track your refund (www.irs.gov/refunds) or pay your balance due (www.irs.gov/payments).