by C7DTeam | Apr 14, 2021 | Firm Updates

2020 Balance Due for Individual Taxpayers How to Pay the IRS and California (FTB) Online IRS The amount due is May 17th, even if you file an extension. Go to: https://www.irs.gov/payments Click on Bank Account (Direct Pay) —you can pay with a credit card/debit...

by C7DTeam | Mar 25, 2021 | COVID-19, Firm Updates, Tax Services

Please take a moment to read through the list below. Do any of those changes impact your situation either for 2020 or 2021? Maybe you are not sure? Did you already file for 2020 and may or may not have taken advantage of those changes, especially bullet points 2...

by C7DTeam | Feb 22, 2021 | Firm Updates, Tax Tips, Taxes

I understand. You get a bonus from your employer and see that taxes were withheld at a whopping 50%! Or something like that. That $3,000 bonus you were expecting ending up being a little more than $1,500 in your bank account. I will get into the details of the data...

by C7DTeam | Jan 25, 2021 | Business, Firm Updates, Taxes

The 2021 tax season is here…or is it? From a delayed tax season to a first, second, and maybe third stimulus check, let’s talk about what’s going on with taxes in 2021 as the pandemic continues to shape the world around us. Accountants and income tax...

by C7DTeam | Jan 8, 2021 | Business, COVID-19, Firm Updates

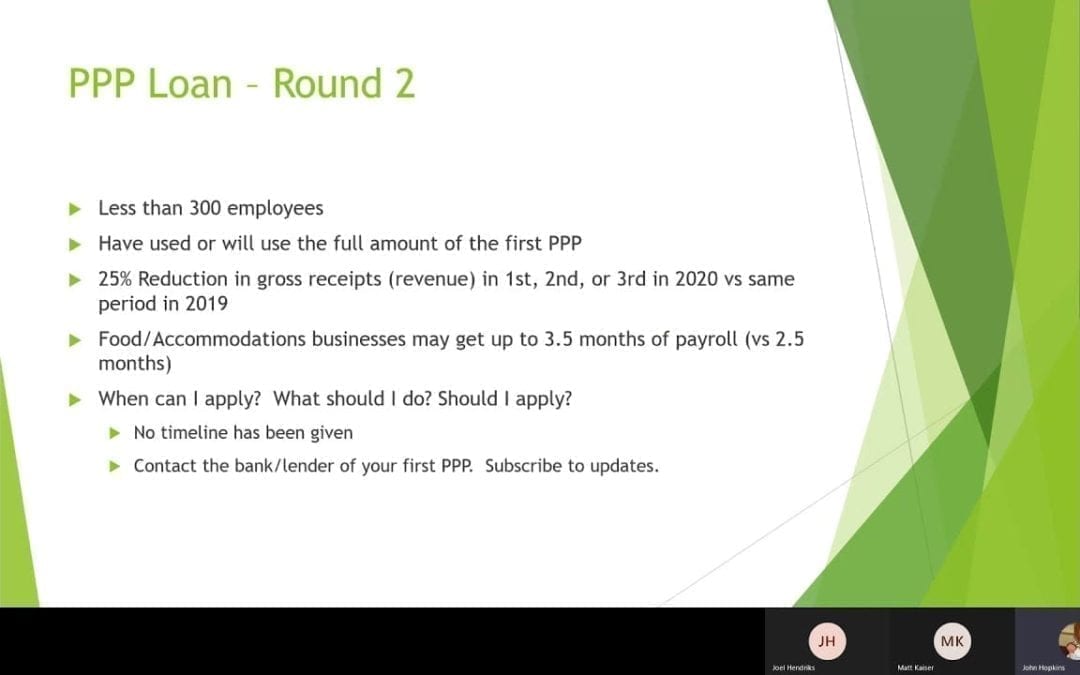

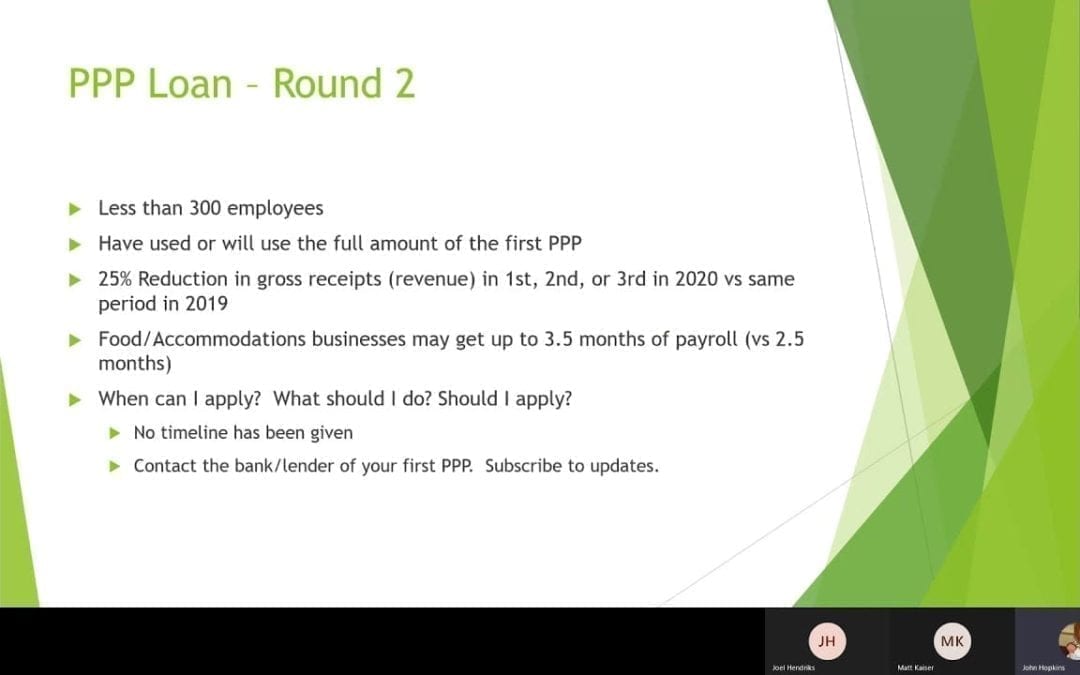

The new bill, signed into law on 12/27/2020, has ramifications for your business. Please take the time to watch the Webinar presented below. Besides covering the 2nd round of PPP and changes to the 1st round of PPP, the Webinar provides updates to payroll tax...

by C7DTeam | Dec 1, 2020 | Business, COVID-19, Firm Updates

01/08/2021 Update: The new Federal COVID-19 bill passed and signed into law in late December overrules the IRS Notice that disallowed deductions used by a forgiven PPP loan. The new law specifically says that forgiven PPP loans will not be income and will not reduce...