by C7DTeam | Mar 25, 2021 | COVID-19, Firm Updates, Tax Services

Please take a moment to read through the list below. Do any of those changes impact your situation either for 2020 or 2021? Maybe you are not sure? Did you already file for 2020 and may or may not have taken advantage of those changes, especially bullet points 2...

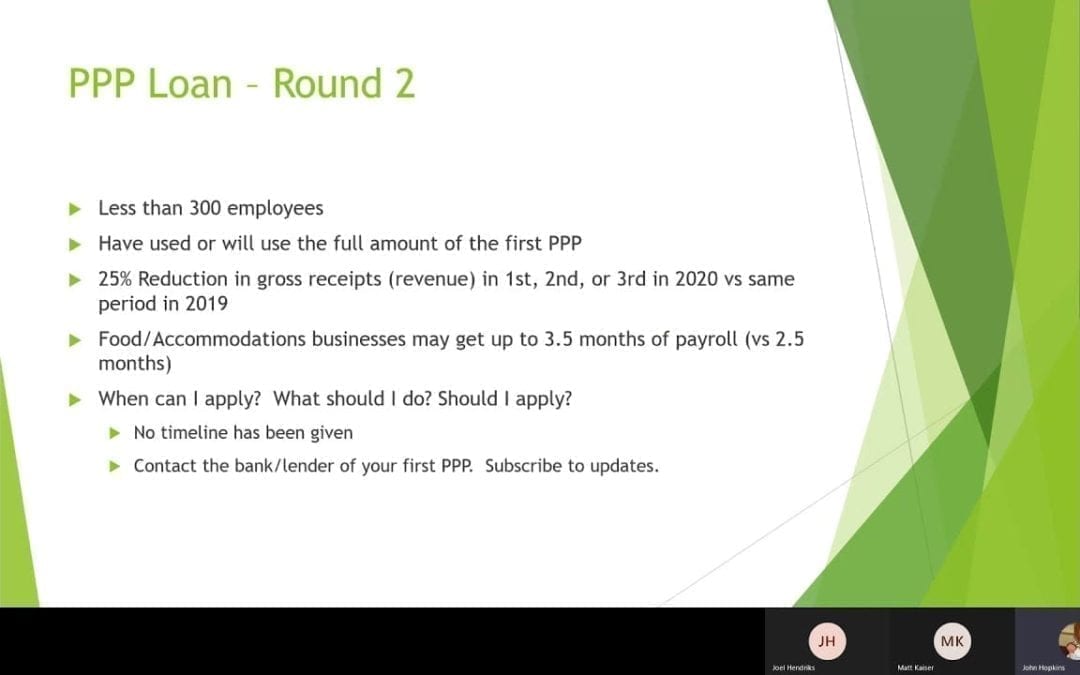

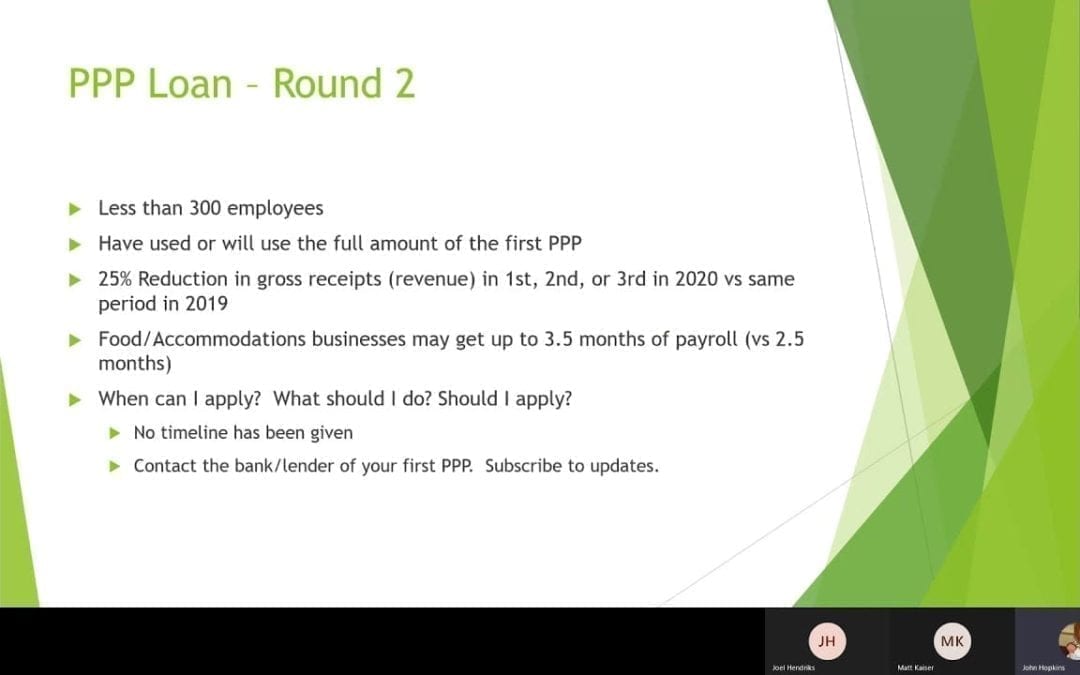

by C7DTeam | Jan 8, 2021 | Business, COVID-19, Firm Updates

The new bill, signed into law on 12/27/2020, has ramifications for your business. Please take the time to watch the Webinar presented below. Besides covering the 2nd round of PPP and changes to the 1st round of PPP, the Webinar provides updates to payroll tax...

by C7DTeam | Dec 29, 2020 | Business, COVID-19

The California Small Business COVID-19 Relief Grant Program Beginning on 12/30/2020, eligible businesses in California can apply for a grant through the California Small Business COVID-19 Relief Grant Program. We recommend reading through our summary below, reviewing...

by C7DTeam | Dec 1, 2020 | Business, COVID-19, Firm Updates

01/08/2021 Update: The new Federal COVID-19 bill passed and signed into law in late December overrules the IRS Notice that disallowed deductions used by a forgiven PPP loan. The new law specifically says that forgiven PPP loans will not be income and will not reduce...

by C7DTeam | Aug 20, 2020 | COVID-19, Payroll, Tax Tips

The relationship between COVID-19 and employment taxes is an everchanging one marked with uncertainty and, as a result, stress for many — employers and employees alike. If you are an employer or employee, gaining some insight on some acts passed regarding the...

by C7DTeam | Jun 18, 2020 | COVID-19, Payroll

We’re sure everybody is wondering about their stimulus checks (or Economic Impact Payment) and many have begun to entertain their money-spending activities as they consider ways to spend their stimulus checks. With talk about money filling the air, people are excited...