by C7DTeam | Feb 22, 2021 | Firm Updates, Tax Tips, Taxes

I understand. You get a bonus from your employer and see that taxes were withheld at a whopping 50%! Or something like that. That $3,000 bonus you were expecting ending up being a little more than $1,500 in your bank account. I will get into the details of the data...

by C7DTeam | Jan 25, 2021 | Business, Firm Updates, Taxes

The 2021 tax season is here…or is it? From a delayed tax season to a first, second, and maybe third stimulus check, let’s talk about what’s going on with taxes in 2021 as the pandemic continues to shape the world around us. Accountants and income tax...

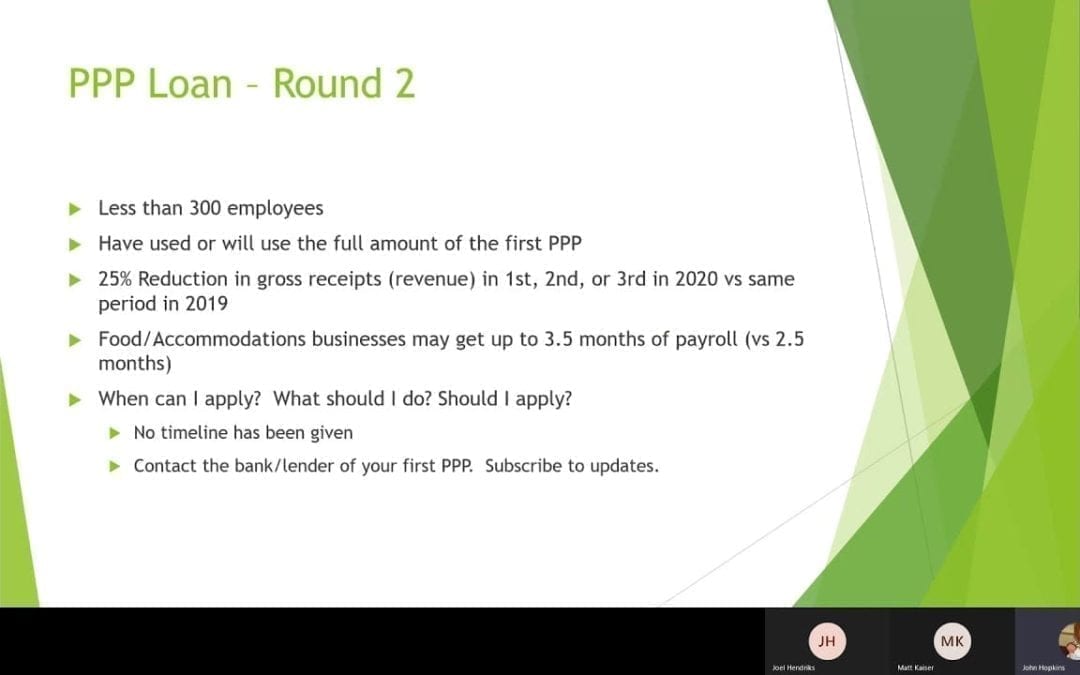

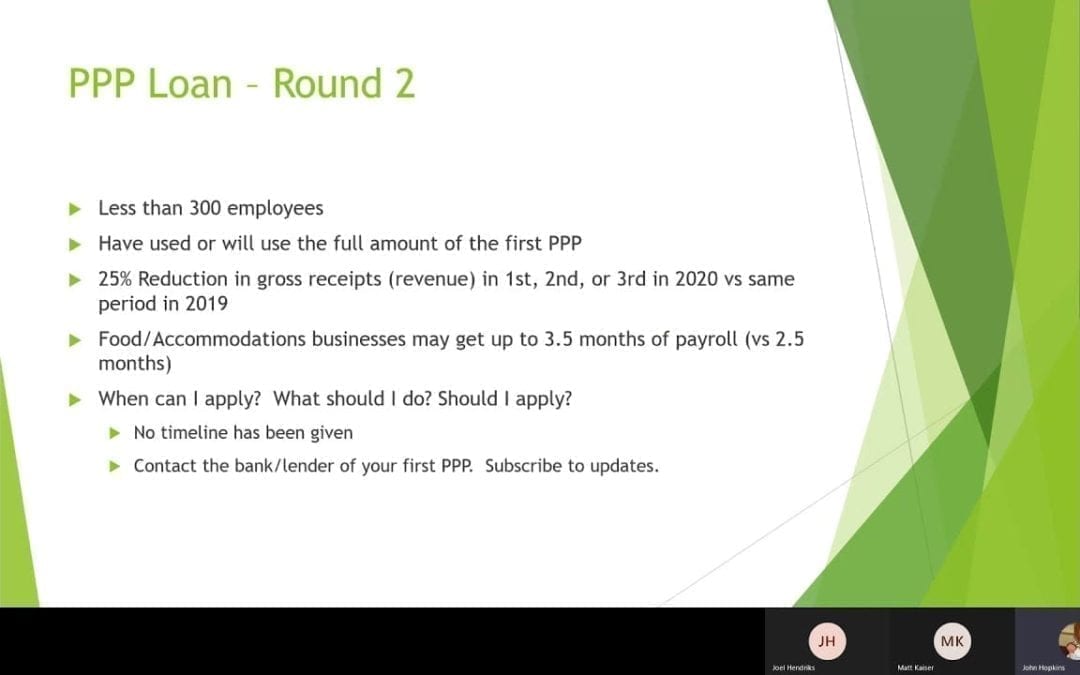

by C7DTeam | Jan 8, 2021 | Business, COVID-19, Firm Updates

The new bill, signed into law on 12/27/2020, has ramifications for your business. Please take the time to watch the Webinar presented below. Besides covering the 2nd round of PPP and changes to the 1st round of PPP, the Webinar provides updates to payroll tax...

by C7DTeam | Jan 7, 2021 | Bookkeeping, Business

Sending Form 1099-Misc and 1099-NEC (Beginning for tax year 2020, the IRS has created a new form called a Form 1099-NEC which replaces the use of Form 1099-Misc for Non Employee Compensation. The rules and practices governing 1099-Misc blogged about below apply to...

by C7DTeam | Dec 29, 2020 | Business, COVID-19

The California Small Business COVID-19 Relief Grant Program Beginning on 12/30/2020, eligible businesses in California can apply for a grant through the California Small Business COVID-19 Relief Grant Program. We recommend reading through our summary below, reviewing...

by C7DTeam | Dec 3, 2020 | Business

California’s governor signs Senate Bill 1447, the Small Business Hiring Tax Credit, to provide financial relief to qualified small businesses for the 2020 economic disruptions that have resulted in unprecedented job losses. Did you know that the recent Small...